Simple ira contribution calculator

A Solo 401 k. Multiply your SIMPLE IRA deferral by your yearly pay to arrive.

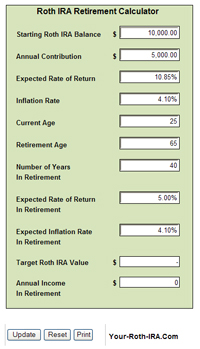

Download Roth Ira Calculator Excel Template Exceldatapro

Use this simple calculator to determine how much a single lump-sum contribution will be worth by retirement in your traditional or Roth IRA.

. Ad Contributing to a Traditional IRA Provides for Tax-Deferred Growth. Ad Discover The Benefits Of A Traditional IRA. Use this calculator to determine your maximum.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. For 2021 contributions cannot exceed 13500 for most people. A One-Stop Option That Fits Your Retirement Timeline.

Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the. We are here to help. Simplify the process of calculating contributions and determining employee eligibility in your business retirement plan with the.

Save for Retirement by Accessing Fidelitys Range of Investment Options. A Traditional IRA Can Be an Effective Retirement Tool. Our Schwab IRA calculators can help you get the information and answers you need to inform your financial decisions.

Employees can contribute up to 14000 a year to a SIMPLE IRA in 2022 which is a 500 increase from 2021. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. SIMPLE IRA Contribution Limits 2021 and 2022 As an employee you can put all of your net earnings from self-employment in to a SIMPLE IRA up to a 13500 maximum in.

For 2022 annual employee salary reduction contributions elective deferrals Limited to 14000. Your Information Amount to consider Current. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

A One-Stop Option That Fits Your Retirement Timeline. Save for Retirement by Accessing Fidelitys Range of Investment Options. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement.

The annual employee contribution limit for a SIMPLE IRA is 14000 in 2022 an increase from 13500 in 2021. The yearly SIMPLE IRA contribution is the most important figure offered by the SIMPLE IRA calculator above. Certain products and services may not be available to all entities or persons.

Enter your name age and income and then click Calculate The result will show a comparison of how much could be contributed into a Solo 401k SEP IRA Defined Benefit Plan or SIMPLE IRA. Learn About 2021 Contribution Limits Today. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

A SIMPLE IRA is funded by. Employees who are 50 and older can make contributions of up to. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Learn About 2021 Contribution Limits Today. Employees who are age 50 and over can make additional catch-up contributions of. Ad Discover The Benefits Of A Traditional IRA.

Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA. The starting point to determine the individuals earned income is the net profit amount from the Schedule C or Schedule K-1 for a partnership. For 2022 its 14000.

For employees age 50 or over a 3000 catch-up contributions. Solo 401k Contribution Calculator. If you would like help or advice choosing investments please call us at 800-842-2252.

A SIMPLE IRA is a retirement plan for small businesses that offers your employees a salary-deferral contribution feature along with a matching employer contribution. Estimate your small business retirement plan contribution. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

Employees 50 and older can make an extra 3000 catch-up. Traditional IRA Calculator Details To get the most benefit from this. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculators

Roth Ira Calculators

Free Simple Ira Calculator Contribution Limits

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Calculator See What You Ll Have Saved Dqydj

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Compound Interest Calculator Roth Ira Online 52 Off Www Ingeniovirtual Com